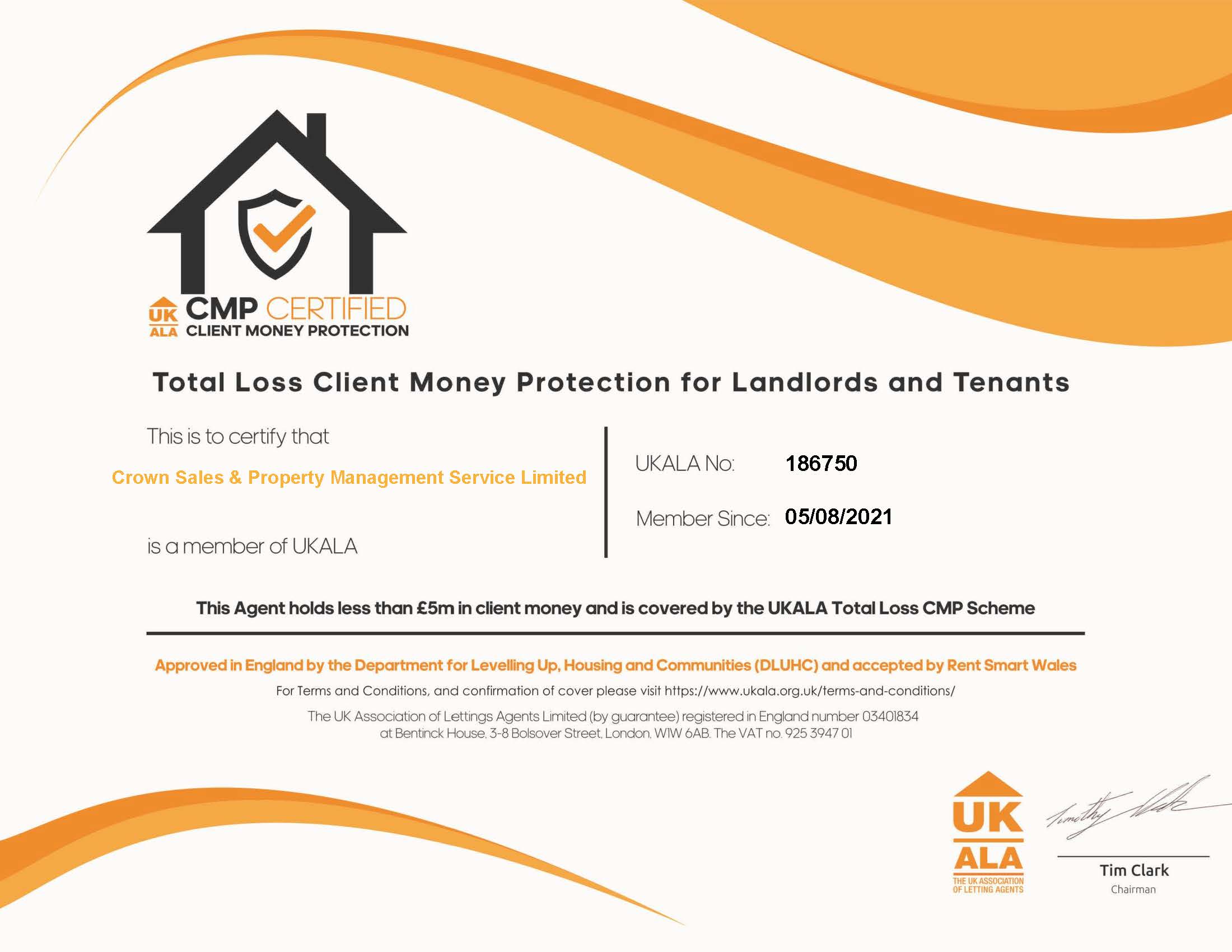

Client Money Protection Scheme

What is a Client Money Protection scheme?

It is a legal requirement for letting agents to join a Client Money Protection Scheme for the benefit of their clients, typically tenants and landlords, in order to safeguard money they hold on their clients’ behalf. In the event that the owners of the business steal or misappropriate any of this money there is a route of redress against the letting agent by contacting the Scheme and claiming against the Scheme. If a genuine claim is accepted by the Scheme, the Scheme will recompense the landlord or tenant and seek recovery from the letting agent or its owners.

A Client Money Protection scheme does not act on behalf of the letting agent. It is an independent membership body that provides the protection of client money whilst held by its members and the Scheme insures its liability for the payment of any claims.

By selecting Crown Sales & Property Management Services Limited as your letting and management agents, landlords do not have to worry about any issues relating to the CMP. We have a dedicated Client Deposit Account and we are members of The UK Association of Letting Agents (UKALA). The UKALA is a professional membership body which supports its agents to comply with the ever-changing regulatory environment. With our experience and knowledge in this area, our consultants will carry out every step of the process with the landlord and tenant, fully complying to the legal requirements ensuring the deposit is fully protected and safe-guarded.

The UK Association of Letting Agents – Client Money Protection (CMP) Guarantee

Who is Covered:

Clients (landlords and tenants) of any current UKALA Member at the time of loss.

What is Covered:

Client Money held by a UKALA Member on behalf of a Client.

What is the limit of cover:

The total of the Client Money which was being held by the UKALA member on behalf of the claimant.

Claim Procedure:

The claimant must notify UKALA in writing of the loss within 3 months of becoming aware of the loss.

What is not covered:

Money which can be recovered from the UKALA member or another scheme or insurance.

Burden of Proof:

In order to establish proof of the loss:

i) All and any information requested must be provided promptly and in any case within 28 days.

ii) UKALA may require the claimant to be involved in legal proceedings against the UKALA member.

Client Money Handling Procedures

As a member of UKALA and in accordance with UKALA Client Money Protection criteria, we adhere to the Rules of Conduct and any other regulations as necessary by using the following procedures:

- All Client Money is held in a Client Money Account with an authorised bank and is easily distinguished from other accounts;

- We maintain one Client Money Account into which all Client Money is paid;

- If requested, we can obtain in writing from our bank confirmation that all Client Money is held by the Business as an agent;

- We have written confirmation that the bank is not entitled to combine or transfer Client Money account(s) with any other account maintained by the business or to exercise any right of set-off or counterclaim against the money in that account in respect of any sum owed to it on any other account of the Business;

- We have systems and controls in place which enable us to monitor and manage Clients’ Money transactions and any risk arising;

- We have accounting systems and client data securely controlled and protected;

- We obtain clients approval to make payments from their account;

- We bank all Clients’ Money at the earliest reasonable opportunity;

- We nominate authorised staff to handle money;

- We keep records and accounts which show all dealings with Client Money and demonstrate that all Client Money held by the business is held in a Client Money Account;

- We reconcile client accounts together with bank and cash balances at regular intervals in order to demonstrate control over the accuracy and completeness of accounting records;

- We ensure there are always sufficient funds in the account to pay all amounts owing to clients;

- We repay any Client Money without delay if there is no longer any requirement to retain that money or the relevant client requests it;

- We publish our procedures for handling Client Money on our website and in our offices; and

- We provide a copy of our procedures for handling Client Money to any person who may reasonably require a copy, free of charge;